B) False

Correct Answer

verified

Correct Answer

verified

True/False

Unused foreign tax credits are carried back two years and then forward 20 years.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Compost Corporation has finished its computation of Federal taxable income. In State Q, the derivation of state corporate taxable income starts with the Federal amount and makes a number of modifications. List at least five such modifications that Compost is likely to encounter. In this regard, follow the general UDITPA rules, and list both addition and subtraction modifications.

Correct Answer

verified

State income tax modifications include the following commonly encountered items. Every state's rules are unique, so thorough research is needed to complete a final list for Compost's location.

Addition modifications

11eaaaea_33ba_2e0b_a4b8_ff75fb469274_TB5432_00 Subtraction modifications

11eaaaea_33ba_2e0c_a4b8_73384dc4354a_TB5432_00

Correct Answer

verified

True/False

A typical state taxable income addition modification is for the Federal income tax paid for the tax year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All of the U.S. states use an apportionment formula based on the sales, property, and payroll factors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

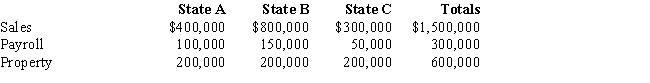

Cruz Corporation owns manufacturing facilities in States A, B, and C. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Cruz's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Cruz's apportionable income assigned to C is:

Cruz's apportionable income assigned to C is:

A) $1,000,000.

B) $273,333.

C) $200,000.

D) $0.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Provide the required information for Orange Corporation, whose Federal taxable income totals $100 million. Orange apportions 70% of its business income to State C. Orange generates $10 million of nonbusiness income each year. Forty percent of that income is attributable to rentals of buildings located in C. Orange's business income this year totals $90 million. a.State C taxes how much of Orange's business income? b.State C taxes how much of Orange's nonbusiness income? c.Explain your results.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wellington, Inc., a U.S. corporation, owns 30% of a CFC that has $50 million of earnings and profits for the current year. Included in that amount is $20 million of Subpart F income. Wellington has been a CFC for the entire year and makes no distributions in the current year. Wellington must include in gross income (before any § 78 gross-up) :

A) $0.

B) $6 million.

C) $20 million.

D) $50 million.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Nico lives in California. She was born in Peru but holds a green card. Nico is a nonresident alien (NRA).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income sourcing is correct?

A) Everything else being equal, a larger foreign-source income decreases the foreign tax credit limitation for U.S. persons.

B) Everything else being equal, a larger foreign-source income increases the foreign tax credit limitation for U.S. persons.

C) Everything else being equal, a larger U.S.-source income increases the foreign tax credit limitation for U.S. persons.

D) Everything else being equal, changing foreign-source income does not change the foreign tax credit limitation for U.S. persons.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. system for taxing income earned outside its borders by U.S. persons is referred to as the territorial approach, because only income earned within the U.S. border is subject to taxation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Subpart F income includes portfolio income like dividends and interest.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Typically, sales/use taxes constitute about 20 percent of a state's annual tax collections.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the U.S. taxation of non-U.S. persons is true?

A) A non-U.S. person's effectively connected U.S. business income is taxed by the U.S. only if it is portfolio income.

B) A non-U.S. person's effectively connected U.S. business income is subject to U.S. income taxation.

C) A non-U.S. person may earn income from selling U.S. real property without incurring any U.S. income tax.

D) A non-U.S. person must spend at least 183 days in the United States before any effectively connected income is subject to U.S. taxation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following persons typically is concerned with the U.S.-sourcing rules for gross income?

A) U.S. persons with only U.S. activities.

B) U.S. persons that earn only tax-exempt income.

C) U.S. persons with U.S. and non-U.S. activities.

D) Non-U.S. persons with only non-U.S. activities.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

All of the U.S. states have adopted a tax based on the net taxable income of corporations.

B) False

Correct Answer

verified

Correct Answer

verified

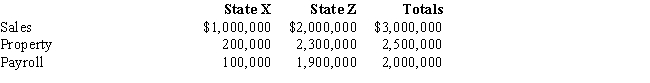

Multiple Choice

Chipper Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z. Chipper's activities establish nexus for income tax purposes only in Z, the state of its incorporation. Chipper's sales, payroll, and property among the states include the following.

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Chipper's taxable income is apportioned to X?

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Chipper's taxable income is apportioned to X?

A) $0

B) $333,333

C) $500,000

D) $1,000,000

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

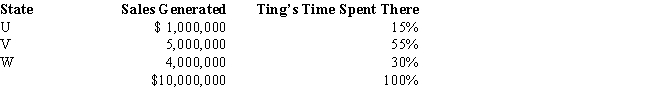

Multiple Choice

Ting, a regional sales manager, works from her office in State W. Her region includes several states, as indicated in the sales report below. Determine how much of Ting's $300,000 compensation is assigned to the payroll factor of State W.

A) $0.

B) $90,000.

C) $120,000.

D) $300,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Britta Corporation's entire operations are located in State A. Eighty percent ($800,000) of Britta's sales are made in A and the remaining sales ($200,000) are made in State B. B has not adopted a corporate income tax. If A has adopted a throwback rule, the numerator of Britta's A sales factor is:

A) $0.

B) $200,000.

C) $800,000.

D) $1,000,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The throwback rule requires that:

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) When an asset is sold, any recognized gain from depreciation recapture is taxed at the rates that applied when the depreciation deductions were claimed.

C) Sales of services are attributed to the state of the seller's domicile.

D) Capital gain/loss is attributed to the state of the seller's domicile.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 129

Related Exams