A) government resources used to enforce tax laws

B) keeping tax records throughout the year

C) paying the taxes owed

D) time spent in April filling out forms

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity and horizontal equity are associated with

A) the benefits principle of taxation.

B) the ability-to-pay principle of taxation.

C) taxes that have no deadweight losses.

D) falling marginal tax rates.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

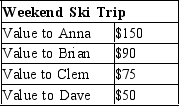

Table 12-1  -Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. Suppose the government imposes a tax of $12 on skiing, which raises the price of a weekend ski pass to $57. What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. Suppose the government imposes a tax of $12 on skiing, which raises the price of a weekend ski pass to $57. What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $41.

B) $95.

C) $144.

D) $185.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 20 percent on the first $50,000 of income and 30 percent on all income above $50,000. What is the marginal tax rate when income is $60,000?

A) 10 percent

B) 20 percent

C) 30 percent

D) 50 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax that generates the most revenue for state and local government is the

A) corporate income tax.

B) individual income tax.

C) property tax.

D) sales tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. tax burden is

A) about the same as most European countries.

B) higher than most European countries.

C) lower than most European countries.

D) higher than all European countries.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the government taxes income in the following fashion: 20 percent of the first $50,000, 40 percent of the next $50,000, and 60 percent of all income over $100,000. Marshall earns $200,000, and Lily earns $600,000. Which of the following statements is correct?

A) Marshall's marginal tax rate is higher than Lily's marginal tax rate.

B) Marshall's average tax rate is higher than his marginal tax rate.

C) Lily's average tax rate is higher than her marginal tax rate.

D) Lily's average tax rate is higher than Marshall's average tax rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the United States, all families pay the same proportion of their income in taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2010, the cochairmen of President Obama's deficit reduction commission proposed curtailing or eliminating the mortgage interest deduction that millions of homeowner taxpayers receive every year. Economists who favor the proposal would argue that

A) (i) only

B) (ii) only

C) (i) and (ii) only

D) (i) , (ii) , and (iii)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Vertical equity is the idea that taxpayers with similar abilities to pay taxes should pay the same amount.

B) Horizontal equity is the idea that taxes should be levied on a person according to how well that person can shoulder the burden.

C) A regressive tax would mean that high-income tax payers pay a larger fraction of their income in taxes than would low-income taxpayers.

D) A proportional tax would mean that high-income and low-income taxpayers pay the same fraction of income in taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 100 years, as the U.S. economy's income has grown,

A) tax rates have decreased, while tax revenues have increased.

B) tax rates have increased, while tax revenues have decreased.

C) both tax rates and tax revenues have increased.

D) both tax rates and tax revenues have decreased.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has lower total government tax revenue as a percentage of GDP than the United States?

A) Canada

B) Germany

C) Sweden

D) Mexico

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Of all the taxes collected in the U.S. economy, what percentage is collected by the federal government?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest budgetary expense for a typical state or local government is

A) public order and safety.

B) welfare.

C) highways.

D) education.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Individual income taxes generate roughly 25% of the tax revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

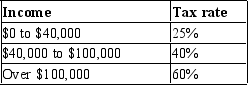

Table 12-4  -Refer to Table 12-4. What is the marginal tax rate for a person who makes $130,000?

-Refer to Table 12-4. What is the marginal tax rate for a person who makes $130,000?

A) 30%

B) 40%

C) 50%

D) 60%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In 2011, the largest source of receipts for state and local governments was corporate income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009, the top 1 percent of income earners made about

A) 1 percent of all income and paid about 1 percent of all taxes.

B) 13 percent of all income and paid about 22 percent of all taxes.

C) 22 percent of all income and paid about 13 percent of all taxes.

D) 50 percent of all income and paid about 50 percent of all taxes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Citizens expect the government to provide various goods and services making taxes

A) inefficient.

B) equitable.

C) inevitable.

D) intolerable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

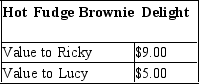

Table 12-2  -Refer to Table 12-2. Suppose that the government imposes a $2 tax on delights, causing the price to increase from $4.00 to $6.00. Total consumer surplus will fall from

-Refer to Table 12-2. Suppose that the government imposes a $2 tax on delights, causing the price to increase from $4.00 to $6.00. Total consumer surplus will fall from

A) $6 to $3.

B) $7 to $4.

C) $6 to $2.

D) $5 to $3.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 549

Related Exams